Future Trends: AI and Biometrics in Insurance

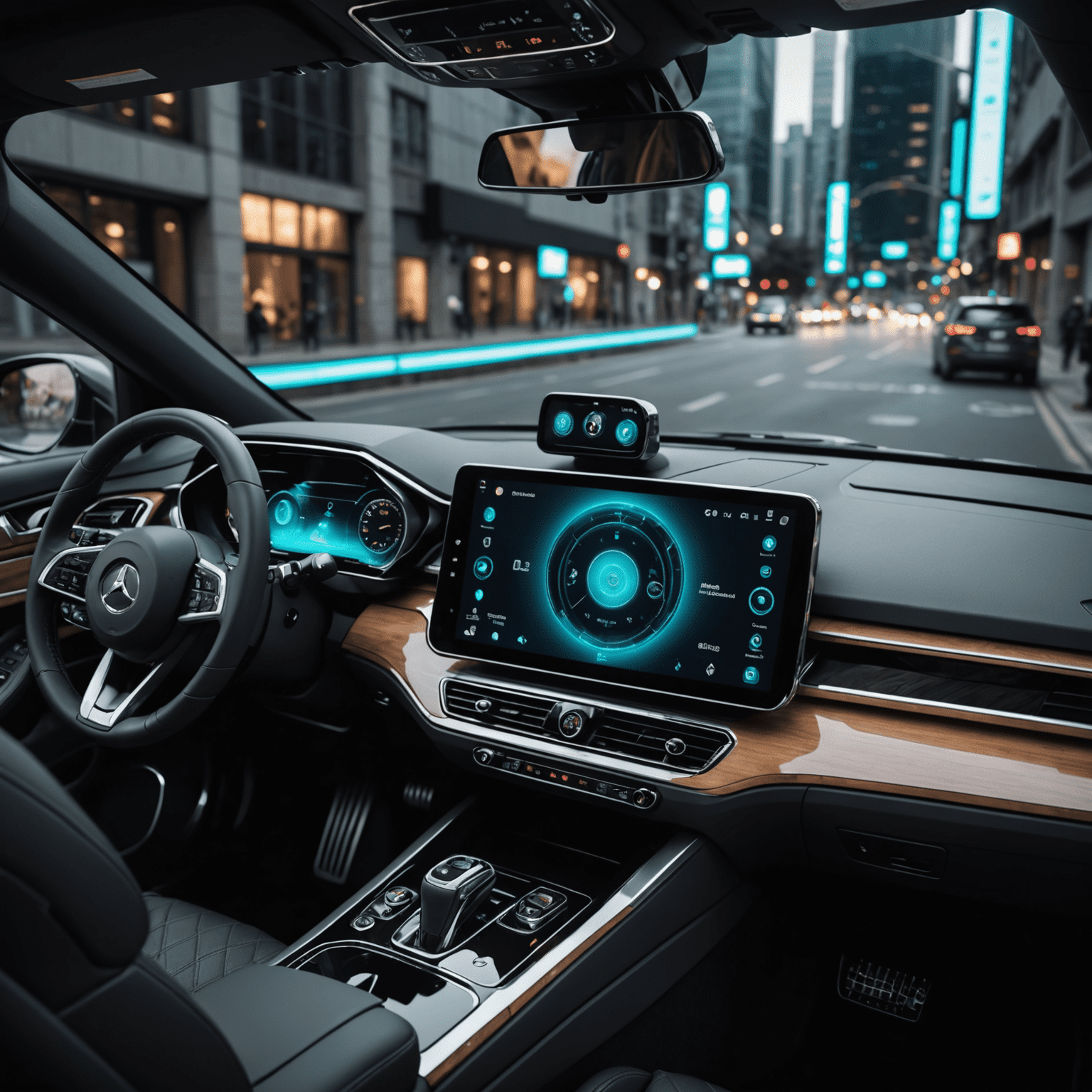

As we venture into the future of car insurance, Vanguard is at the forefront of a revolution that combines artificial intelligence (AI) and biometric technology. This fusion is set to transform how we approach risk assessment, pricing, and overall customer experience in the automotive insurance sector.

The Rise of Biometric Car Insurance

Biometric identification is no longer confined to unlocking smartphones; it's making significant inroads into the world of car insurance. By leveraging unique biological traits such as fingerprints, facial recognition, and even driving behavior patterns, insurers can create highly personalized policies that reflect individual risk profiles with unprecedented accuracy.

AI Integration: The Brain Behind Biometrics

Artificial Intelligence serves as the cornerstone for processing and analyzing vast amounts of biometric data. Here's how AI is enhancing biometric car insurance:

- Real-time Risk Assessment: AI algorithms can process biometric data in real-time, adjusting risk profiles on the fly based on current driving behavior.

- Fraud Detection: Advanced AI systems can detect anomalies in biometric data, significantly reducing insurance fraud.

- Predictive Analytics: By analyzing patterns in biometric data, AI can predict potential risks before they occur, allowing for proactive measures.

Vanguard's Approach to Biometric Innovation

At Vanguard, we're not just following trends; we're setting them. Our team in Canada is working tirelessly to develop cutting-edge solutions that harness the power of biometrics and AI. Here's how we're staying ahead of the curve:

- Individual Tariffs: We're moving beyond traditional pricing models to offer truly personalized rates based on comprehensive biometric profiles.

- Continuous Monitoring: Our systems provide ongoing assessment, rewarding safe driving habits in real-time.

- Enhanced Customer Experience: Biometric authentication simplifies claims processing and policy management, making insurance interactions seamless and secure.

The Future is Now: Predictive Analytics in Action

One of the most exciting developments in our biometric insurance model is the integration of predictive analytics. By analyzing vast datasets of driving behavior, environmental conditions, and vehicle diagnostics, our AI can forecast potential risks with remarkable accuracy. This not only allows us to offer more competitive rates but also enables us to provide proactive safety recommendations to our policyholders.

Ethical Considerations and Data Privacy

As we push the boundaries of technology in insurance, Vanguard remains committed to upholding the highest standards of ethics and data privacy. We understand the sensitive nature of biometric data and have implemented state-of-the-art security measures to protect our clients' information. Our transparent policies ensure that customers always have control over their data and how it's used.

Looking Ahead: The Road to Fully Personalized Insurance

The integration of AI and biometrics in car insurance is just the beginning. As technology continues to evolve, we envision a future where insurance policies are as unique as the individuals they cover. From adjusting coverage based on lifestyle changes to offering micro-insurance options for specific trips or activities, the possibilities are endless.

At Vanguard, we're not just preparing for this future – we're actively shaping it. Our commitment to innovation ensures that we'll continue to offer the most advanced, personalized, and fair insurance solutions in the market.

As we continue to innovate in the realm of biometric car insurance, Vanguard remains dedicated to providing cutting-edge solutions that prioritize individual needs, enhance safety, and revolutionize the insurance experience for drivers across Canada and beyond.